The world of personal banking is changing. In previous decades, bankers would find a branch in their town and bank there for their whole lives. Bankers would deposit checks and withdraw money at the welcome counter, open savings accounts with the help of a friendly representative, and set up their loved ones with joint accounts at the same branch. Banking used to be personal, and the look, feel and location of your branch mattered more than anything.

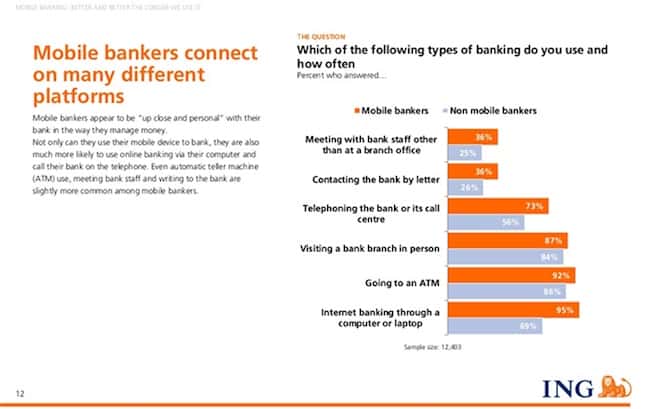

Now, banking is detached and segmented. Since the innovation of the ATM machine, where and how a person gets their money has become less and less personal, and yet it has become more and more personalized to their customer experience. With the rapidly growing popularity of online banking, customers are caring less about free lollipops at local branches, and more about integrated apps and freedom to choose. Customers are less loyal, more savvy, and have way more choices.

How does the banking sector keep up with this massive change by offering an enjoyable customer experience?

The banking customer experience by Capital One

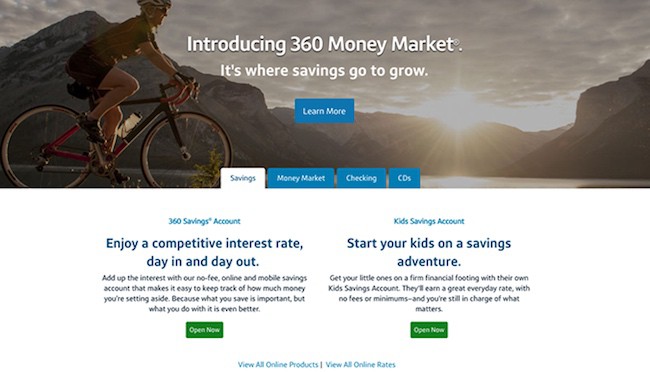

Some companies, like Capital One, are already starting to embracing it. New products like the Capital One 360 bank account allows customers to set up an unlimited amount of savings accounts, managed completely online, at the click of a button. The “360” option offers customers a complete view of their account activity across all accounts on a user-friendly, easy-to-read dashboard.

The Capital One 360 program has delivered a product that hopes to appeal to today’s millennial banking customer: open to new things, interested in convenience, but wary as ever of proper security. Capital One has even gone so far as to create Capital One Cafes, which strive to be a millennial’s paradise as a cool place to hang out and drink coffee with free banking advice and, of course, free wifi. By investing in making these changes, Capital One is demonstrating how important it is for the banking sector to improve the customer experience by listening to their customer, turning feedback into action, embracing technology, and embracing a remote banking experience.

Now, let’s have a look at the 4 ways that banks can improve their customer experience, and how to take practical steps to implement them.

#1 Listening to the customers of your bank

No matter the sector, if a company is looking to improve their customer experience, the first place to start is by collecting feedback from the customers you want to target. Ask your customers, current or prospective, what bothers them about the traditional banking model, and how you can stand apart with new services.

People want to make their life easier, and they will embrace the opportunity to tell you what they need. Listening to your customers also means accepting honest criticisms and taking a look at what parts of your company need work.

All in all, listening to your customers is about purging preconceived notions about what you think your customer wants, and finding out what they actually want. Despite recent feedback innovations, surveys remain the best and easiest way to ask customers about their likes, wants, and challenges.

Discover How the French banking group BPCE exploits Customer Voice to develop its new services.

#2 Turning feedback into action

Getting feedback is one thing, actually doing something with it is another. Once you get the feedback you need from your customers, you need to get a team together to strategize what you can realistically implement, and how to do it.

Not every bank is going to be able to create national banking cafes, but maybe you can create a better equipped mobile app that will allow your customers to cash checks online. Every baby step towards meeting their needs will help your company in the long run, and let your customers know that you’re making an effort.

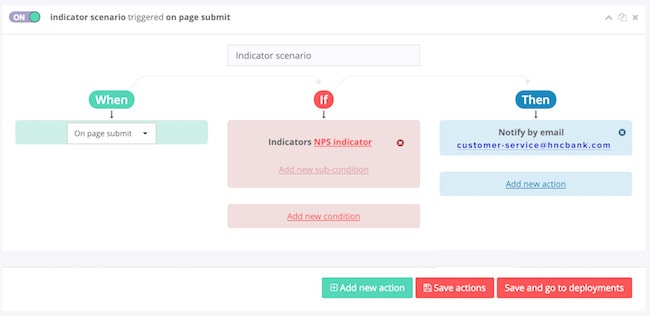

the action must also be taken at the level of the customer who gave the feedback. If the customer is not satisfied with his experience, your customer service should be notified immediately and called back as soon as possible. This type of notifications can be easily implemented with an Enterpise Feedback Management platform.

Example of a scenario to trigger an email notification after having collected a NPS score

#3 Embracing new banking technology

As a general rule, meeting your customers needs will get easier and easier over time if you decide to embrace technology now. Though it absolutely comes at an expense, the reality is that the industry is not moving backwards, and catching your bank up to the industry technological norms five years from now will be just as difficult, if not more so.

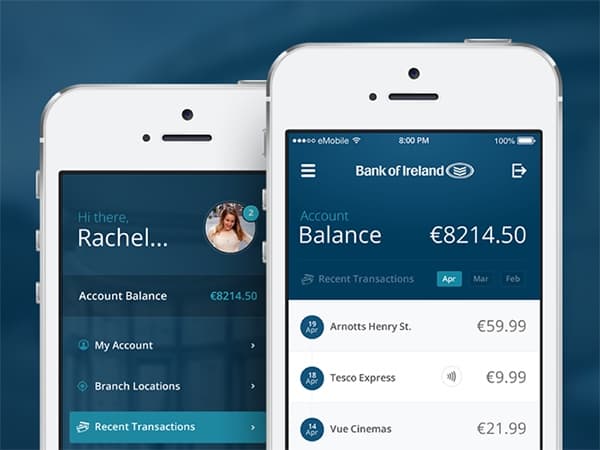

Slowly integrating online banking features, comprehensive mobile apps, online account set-up and management, and email tech support will ultimately save your bank money and give you the upper hand over competitors that are slow to catch up.

#4 Embracing Remote Banking

None of the major banks have completely eliminated physical branches just yet, and Capital One Cafes are proof that banks are continuing to support the idea of having a physical location where customers can speak to experts face to face. However, a great way to improve your customer experience is shifting the focus of your store from the brick and mortar building to your online and remote capabilities. By perfecting the remote banking experience, you will allow more customers to embrace this convenient way of banking and earn their loyalty by creating a system that fits into their busy lives.

Whether or not Capital One’s new approach will succeed will depend on their ability to listen to feedback, continue to develop their services to meet their customer’s needs, and avoid appearing too desperate or trendy. All of these things depend on getting good feedback, turning it into strategic action, and using technology and remote options in the smartest way. This is the right approach for any bank looking to improve their relationship with their evolving consumer.